|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

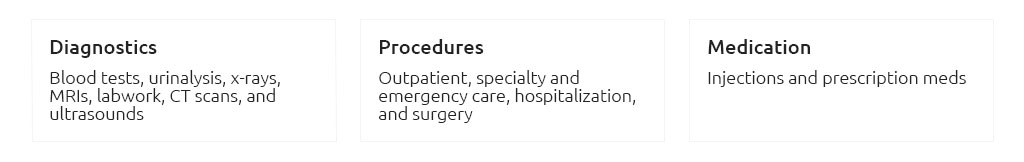

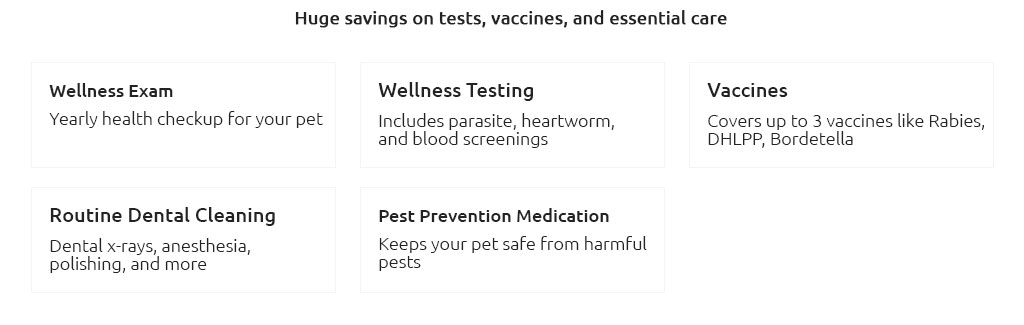

Cheap Pet Insurance Near Me: Finding Affordable Options for Your Furry FriendsFinding the right pet insurance that fits your budget and meets your pet's needs can be challenging. With numerous options available, it's important to consider various factors to ensure you make the best choice. Understanding Pet InsurancePet insurance helps cover unexpected veterinary costs, ensuring that your pet receives necessary medical care without straining your finances. To explore the cost of pet insurance per year, you can visit this detailed guide. What Does Pet Insurance Cover?Most pet insurance plans cover accidents, illnesses, and routine care. However, coverage can vary widely between policies, so it's crucial to read the terms carefully. Factors to Consider When Choosing Pet InsuranceWhen selecting a pet insurance plan, consider these key factors:

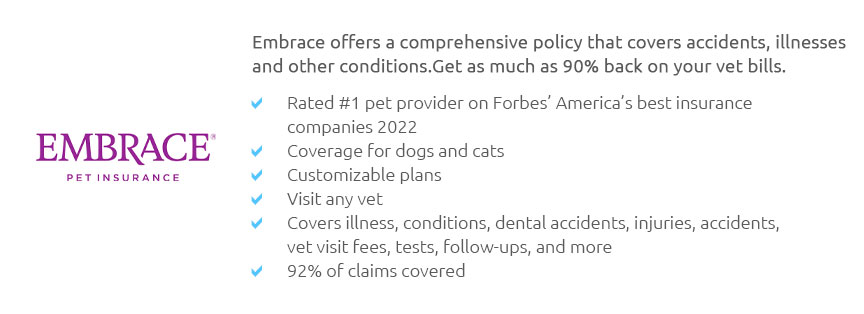

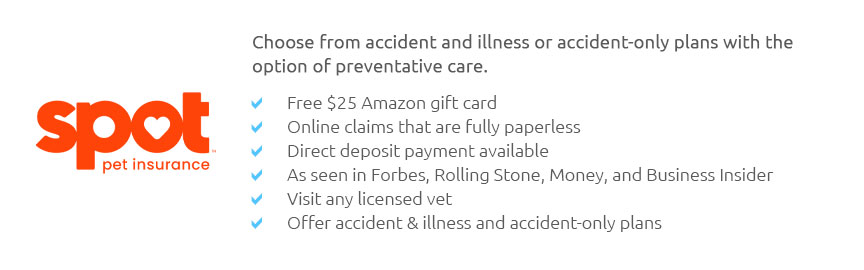

Comparing Different Pet Insurance OptionsResearching different pet insurance policies can help you find one that balances cost and coverage effectively. How to Find Cheap Pet Insurance Near You

Frequently Asked QuestionsWhat is the average cost of pet insurance?The average cost can range from $20 to $60 per month, depending on the coverage and the pet's age, breed, and location. Is pet insurance worth it?Pet insurance can be worth it if you want financial protection against unexpected veterinary costs. It ensures your pet gets necessary medical care without financial stress. Can I get pet insurance for older pets?Yes, many insurers offer coverage for older pets, though premiums may be higher and coverage options more limited. https://www.pawlicy.com/pet-insurance-usa/ct/

Dog Insurance - Cat Insurance. TOOLS & RESOURCES. Get Quotes - Compare Providers - Pet Insurance by State - Find Vets Near Me - Pet Health Tips - Pet Insurance ... https://www.libertymutual.com/pet-insurance

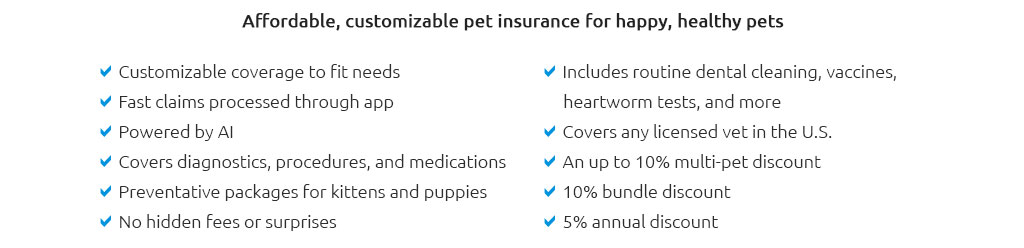

Affordable pet insurance, customized for you. What is pet ... https://www.forbes.com/advisor/pet-insurance/best-pet-insurance-connecticut/

... closest option available. Source: Forbes Advisor ... Next Up In Pet Insurance. Best Pet Insurance Companies - Best Cheap Pet Insurance ...

|